سلة التسوق الخاصة بك فارغة

هل لديك حساب بالفعل؟ تسجيل الدخول للتحقق بشكل أسرع.

هل لديك حساب بالفعل؟ تسجيل الدخول للتحقق بشكل أسرع.

In the world of business growth and customer acquisition, understanding your Customer Acquisition Cost (CAC) Payback Period isn't just helpful—it's essential for sustainable success. Whether you're a startup in Colombo or an established enterprise across Sri Lanka, this critical metric can make the difference between profitable growth and cash flow disaster.

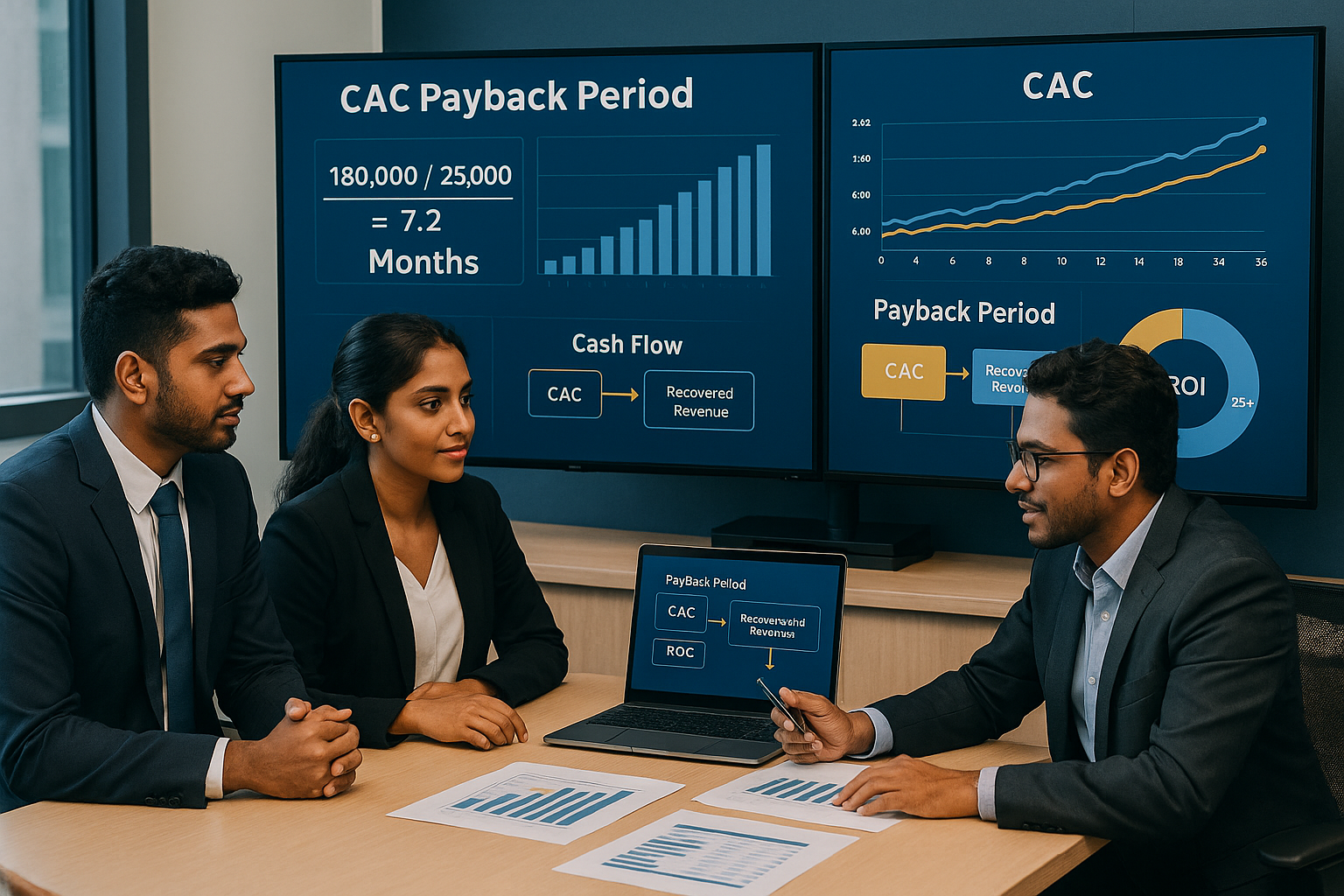

Customer Acquisition Cost (CAC) Payback Period measures how long it takes for a newly acquired customer to generate enough revenue to recover the cost of acquiring them. Simply put, it answers the crucial question: "When will this customer investment start paying off?"

The Formula: CAC Payback Period = Customer Acquisition Cost ÷ Monthly Recurring Revenue per Customer

For example, if you spend LKR 50,000 to acquire a customer who pays LKR 10,000 monthly, your payback period is 5 months.

Many businesses focus solely on revenue growth without understanding the cash flow implications of customer acquisition. A long payback period means you're essentially lending money to your future self—and if that period is too long, you might run out of cash before seeing returns.

Real-world Impact: A Sri Lankan SaaS company might acquire 100 new customers monthly at LKR 30,000 each, requiring LKR 3 million upfront investment. If the payback period is 12 months, they need substantial working capital to sustain growth. Understanding this helps prevent the common scenario where growing companies suddenly face cash crunches despite increasing revenue.

CAC Payback Period directly influences how aggressively you can invest in growth. A shorter payback period means you can reinvest returns faster, creating a compounding effect that accelerates sustainable growth.

Strategic Advantage: Companies with payback periods under 6 months can typically reinvest profits twice as fast as those with 12-month periods, leading to exponentially faster market capture.

For businesses seeking funding or reporting to stakeholders, CAC Payback Period demonstrates operational efficiency and market viability. Investors use this metric to assess risk and potential returns, making it crucial for securing growth capital.

Excellent Performance: 3-6 months

Acceptable Range: 6-12 months

Concerning Territory: 12+ months

Channel Performance Analysis: Track CAC across different acquisition channels. Digital channels often provide better tracking and optimization opportunities than traditional methods.

Pricing Strategy Optimization: Regular pricing analysis ensures you're capturing appropriate value without deterring customers.

Onboarding Excellence: Faster time-to-value reduces churn and improves early revenue generation.

At Gallery HR, we understand that HR technology investments must demonstrate clear value quickly. Our clients typically see CAC payback periods of 4-6 months because:

Immediate Value Delivery: Organizations start saving time and reducing errors from day one of implementation, creating instant ROI that shortens payback periods.

High Retention Rates: HR systems become integral to daily operations, resulting in low churn rates and extended customer lifetime value.

Expansion Revenue: As organizations grow, they naturally increase their usage and subscription levels, improving revenue per customer over time.

Not all customers are created equal. High-value segments might justify longer payback periods, while volume segments require quick returns.

Acquiring more customers isn't always better if it extends payback periods beyond sustainable limits.

Poor onboarding or customer success processes can delay revenue realization and extend payback periods.

Without proper analytics, businesses can't identify which acquisition strategies provide the best payback periods.

Understanding and optimizing your CAC Payback Period isn't just about financial metrics—it's about building a sustainable, scalable business model. Companies that master this metric position themselves for:

Immediate Actions:

Medium-term Strategy:

Long-term Planning:

CAC Payback Period is more than just another business metric—it's a fundamental indicator of business health and growth sustainability. In today's competitive market, businesses that understand and optimize this metric will outpace those that focus solely on growth without considering the cash flow implications.

Whether you're evaluating HR software investments like Gallery HR or any other business solution, understanding the payback period helps ensure your growth strategies are both ambitious and sustainable.

Ready to optimize your business metrics? Start by calculating your CAC Payback Period today, and discover how this powerful metric can transform your approach to sustainable growth.

Gallery HR helps businesses optimize their HR investments with solutions designed for quick payback periods and long-term value. Contact us to learn how our approach to workforce management can improve your business metrics.

Don’t miss this opportunity to upgrade your HR operations and join the growing list of businesses in Sri Lanka achieving success with GalleryHR.

GalleryHR is committed to helping Sri Lankan businesses thrive with smarter, more efficient HR solutions. Partner with us today and experience the difference.

Join our empire today!

0 تعليقات